Proudly Featured In:

Trying to build wealth on your own may already be costing you more than you think.

Without a clear plan, doubt and disorganization creep in, and financial confidence stays just out of reach.

You've done harder things. Now it's time to take the reins and build a financial life you're proud of, with a partner you can trust.

Our specialized services are created to meet you where you are in your personal financial journey.

Premium Wealth Accelerator

This coaching and mentorship program provides a safe and confidential space to develop your unique financial blueprint. We do this with one-to-one strategy calls, educational content, workbooks, and weekly group Q&A sessions.

I personally developed this program to thoughtfully take you through each pillar of the Her Wealth Coach Blueprint. You'll walk away with a plan tailored just for you, along with the support and confidence necessary to continue your progress.

The next cohort begins in April, 2026

1:1 Private Wealth Coaching

Your exclusive six-month program will take an all-encompassing approach to your financial aspirations with a strategy tailored just for you.

This service is designed for a female business owner or executive earning at least $250,000 annually who aspires to transition into wealth smoothly and efficiently, alongside a partner dedicated to help them be financially secure.

Please schedule a call using the link below so we can determine if we are a good fit.

Accepting applications for 2026

Personalized Social Security Optimization

This service is designed to help you make one of the most important decisions about your retirement with clarity and confidence.

Through personalized analysis and expert strategy, we’ll map out the Social Security claiming approach that best supports your income, your spouse's income, the potential income of a former spouse, as well as surviving spousal options for widows/widowers.

No guesswork, just guidance grounded in your real numbers and real life.

Scheduling sessions for February, 2026

We know that managing your money can feel complicated.

And it can be even more stressful when you're beginning a new season of life.

But here's what I also know:

You don't have to figure it all out alone.

With over 30 years of experience helping women navigate financial transitions with confidence, we bring both proven strategy and real-life perspective.

At Her Wealth Coach®, we combine expert guidance with compassion and education so you can lead your life with clarity, strength, and purpose.

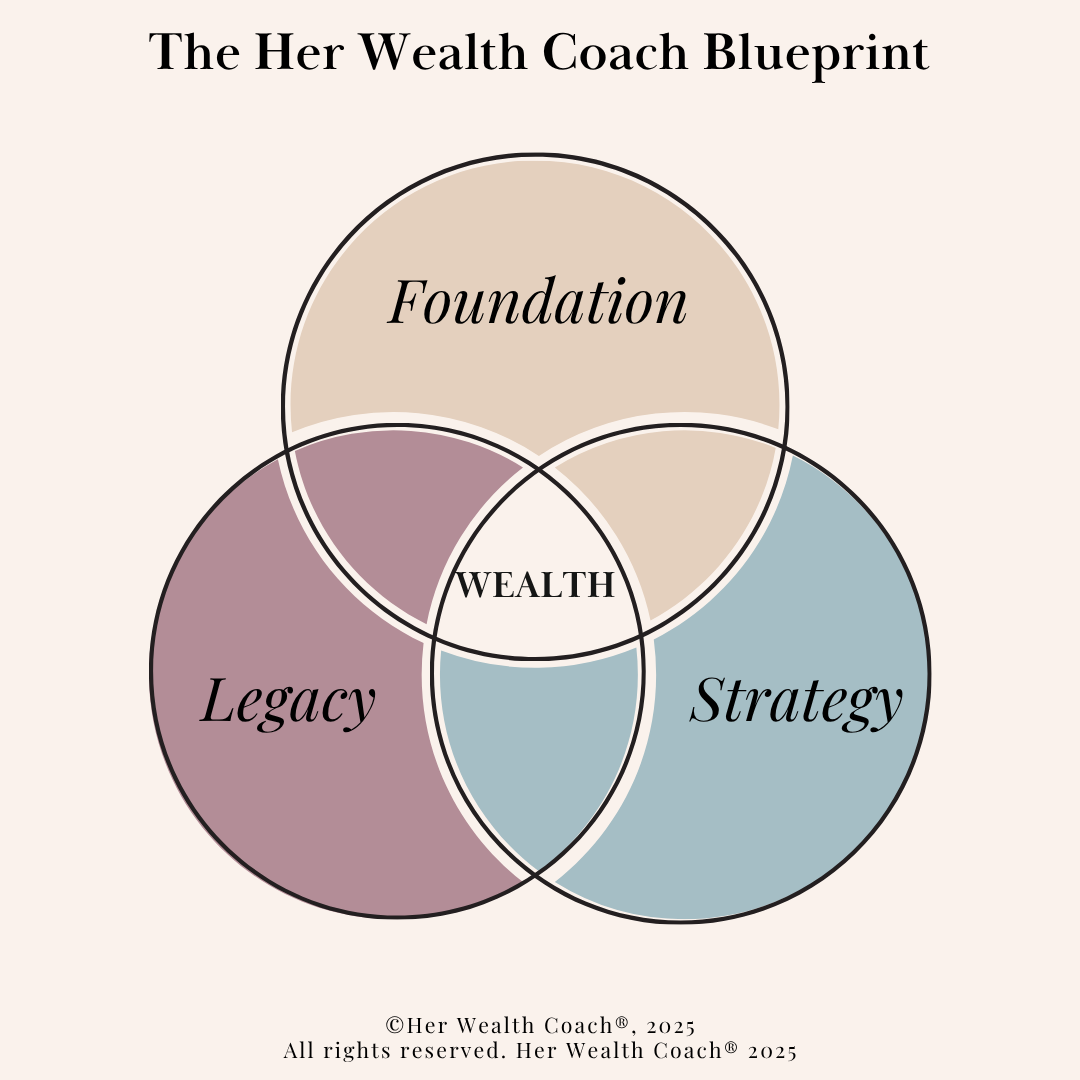

Three Pillars With One Purpose:

Your Financial Peace of Mind

At the heart of everything we do is the Her Wealth Coach Blueprint® - a proven framework designed to guide you through every stage of your financial journey .

Foundation: Where clarity begins.

We start by grounding your financial life with a mindset built for success, a spending plan that reflects your priorities, and the essential protections that let you sleep at night.

Strategy: Where your goals take shape.

From investment basics to retirement planning and proper asset titling, this is where your money starts working for you with intention, structure, and smart decision-making.

Legacy: Where meaning meets wealth.

We help you prepare for what matters most - from estate planning to wills, trusts, and advanced insurance - so your impact lasts far beyond your lifetime.

What our clients are saying...

“It was so refreshing to work with Laurie!

There was never a moment of condescending comments or suggestions. She took the time to understand my financial goals, and then we spent our Power Hour discussing specific, actionable steps to meet those objectives.

It is such a relief and comfort to know that I am now confident in my financial plan moving forward.”

- Candace Galiffa

President, NewWay Accounting

"I wasn’t sure what to expect when I began seeking guidance on Social Security spousal benefits.

She took the time to explain precisely how the process would work. Laurie reviewed my circumstances, evaluated my options, and laid out the most advantageous strategy for my situation. Following our session, I knew exactly what my next steps were and felt confident about how to claim my maximum benefit!

Don't hesitate! Laurie is your expert to guide you through the complicated web of Social

Security!”

- Debra Kay, Ph.D.

A Note From Our Founder

When women are equipped with the right tools, knowledge, and support, everything changes.

I know the quiet weight you've been carrying - the pressure to be smart with your money, even when no one ever taught you how.

The late night Googling.

The well-meaning but conflicting advice.

The feeling that you should already know more than you do.

At Her Wealth Coach®, we create a judgement-free space where women like you can finally make sense of it all. Through our proven framework and personalized support, you'll gain not only clarity and confidence, but a financial life that reflects your values, supports your goals, and prepares you for whatever comes next.

Here's to the place where women prosper together and build a more empowered relationship with their wealth!

Laurie Bodisch, CTFA™, RSSA®

Founder, Her Wealth Coach®